What are five marketing strategies that retailers spend half of their annual budget on?

The question of "what are five marketing strategies that retailers spend half of their annual budget on?" touches a nerve for anyone who’s watched retail marketing transform over the past decade. As e-commerce and in-store experiences converge, the ways retailers allocate their often staggering marketing budgets have shifted remarkably. But which strategies consistently command the lion’s share of spending, and why do they remain so dominant?

The Big Five: Where Retailers Invest Their Marketing Dollars

Retailers, from global giants to neighborhood boutiques, wrestle with the reality of fragmented consumer attention and rapidly changing technology. As a result, their marketing budgets often gravitate toward five tried-and-tested strategies that promise both reach and measurable impact. According to a combination of industry reports (for example, Deloitte’s annual CMO Survey and recent insights from the National Retail Federation), these strategies collectively swallow up nearly half of the average retailer’s annual marketing budget.

Let’s break down these core strategies, showcase real-world examples, and outline actionable ways for retailers to execute them effectively.

Table 1: The Five Core Marketing Strategies and Their Typical Budget Allocation

| Strategy | % of Typical Annual Marketing Budget | Key Channels/Tools | Example Brands Using This Strategy |

|---|---|---|---|

| Digital Advertising (Search & Social) | 15-20% | Google Ads, Meta, TikTok, YouTube | Nike, Target, Sephora |

| In-Store Promotions & Events | 8-12% | POS displays, events, sampling | Walmart, Costco, Macy’s |

| Email Marketing & Automation | 7-10% | Email verification, automation, segmentation | Best Buy, Nordstrom, REI |

| Loyalty & Rewards Programs | 7-10% | Mobile apps, email, POS integration | Starbucks, Walgreens, Ulta Beauty |

| Content Marketing & Influencer Campaigns | 7-10% | Blogs, video, social influencers | Glossier, Lululemon, H&M |

These figures can, of course, fluctuate by sector and retailer size, but the dominance of these five categories is nearly universal. Let’s explore why each deserves such a large slice of the budget-and how to maximize the return on these investments.

Digital Advertising: Dominating the Allocation

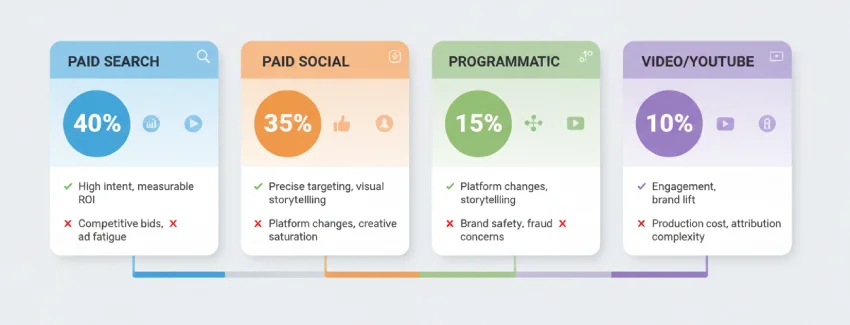

Digital advertising remains the single largest marketing cost center for most retailers. Whether through paid search (Google Ads), social media platforms (Meta, TikTok, YouTube), or programmatic display, this category’s reach and targeting power are unmatched. Retail marketers chase consumers where they spend their time-online, scrolling, searching, and streaming.

Table 2: Digital Advertising Breakdown

| Channel | Typical Spend Share (of digital ad budget) | Advantages | Challenges |

|---|---|---|---|

| Paid Search | 40% | High intent, measurable ROI | Competitive bids, ad fatigue |

| Paid Social | 35% | Precise targeting, visual storytelling | Platform changes, creative saturation |

| Programmatic | 15% | Scale, audience data | Brand safety, fraud concerns |

| Video/YouTube | 10% | Engagement, brand lift | Production cost, attribution complexity |

Retailers like Sephora and Nike showcase creativity and precision with seasonal campaigns that adapt in real-time to consumer behavior, using data-driven insights to optimize spend. The challenge? Digital ad costs climb yearly, and privacy changes (such as the end of third-party cookies) demand ever-sharper strategies.

A practical tip: always pair digital ad investment with continual A/B testing-not just for visuals and copy, but also landing page experiences. Small tweaks can yield big gains in click-through and conversion rates.

In-Store Promotions and Experiential Events

Despite the digital revolution, in-person retail experiences hold enormous sway. Retailers pour budget into point-of-sale (POS) displays, limited-time offers, product demos, and large-scale events. The tactile, human side of shopping drives not only immediate sales but also long-term loyalty and positive buzz.

Consider the annual holiday displays at Macy’s or the in-store tasting events hosted by Whole Foods. These immersive experiences create emotional connections that digital-only campaigns often struggle to match.

Table 3: In-Store Engagement Tactics

| Promotion/Event Type | Budget Allocation (% of in-store promo budget) | Example | Measurable Impact |

|---|---|---|---|

| POS Displays | 40% | Endcap product showcases | Lift in featured product sales |

| Sampling/Demos | 30% | Food, beauty, or tech sampling | Increased trial, conversion |

| Store Events | 20% | New collection launches, workshops | Foot traffic, social mentions |

| Store-Only Discounts | 10% | Exclusive in-store coupons | Redemption rate |

For retailers, the challenge lies in measuring results. Technology-like mobile redemption codes or beacons-now helps attribute in-store activity to specific campaigns, marrying the physical and digital storytelling.

Email Marketing and Automation: The "Silent Workhorse"

The most undervalued (but reliably high-ROI) strategy on the list is, without doubt, email marketing. Retailers allocate a significant chunk of budget to platforms that support bulk email campaigns, email deliverability, automation, and segmentation. While social ads get the limelight, email remains personal, direct, and conversion-focused.

Successful retailers leverage tools for email verification and sender reputation management to keep campaigns out of spam folders and in front of real customers. Companies like Best Buy and Nordstrom segment their audiences by past purchase behavior-offering tailored recommendations and exclusive offers.

Tutorial: How to Set Up an Effective Retail Email Campaign

- Start with Clean Data: Use email verification tools such as SendBridge to ensure your list is free from invalid or outdated addresses.

- Segment Your Audience: Divide your customers by preferences, location, purchase frequency, or lifecycle stage.

- Automate and Personalize: Use automation tools to send personalized product recommendations, birthday offers, or cart abandonment reminders.

- Test and Optimize: Try A/B testing for subject lines, send times, and email layouts. Analyze open rates, click rates, and conversions.

- Monitor Deliverability: Regularly check sender reputation and run SMTP testing to maximize inbox placement.

A real-world example: REI uses its Co-op member data to craft ultra-targeted campaigns featuring local workshops, gear offers, and educational content, driving higher open rates and in-store visits.

Loyalty and Rewards Programs: Building Emotional Currency

Retailers recognize that retaining an existing customer is far more cost-effective than acquiring a new one. Enter loyalty programs-designed to increase purchase frequency, average order value, and customer lifetime value. From mobile apps that track points to email campaigns highlighting exclusive rewards, this strategy eats up a reliable percentage of the budget.

The Starbucks Rewards app is a prime example, blending a simple points system with occasional "bonus star days" and personalized offers. These programs not only foster stickiness but also serve as a rich source of zero-party data, fueling future marketing efforts.

Table 4: Key Elements of Retail Loyalty Programs

| Program Feature | Importance | Example in Action | Benefits for Retailers |

|---|---|---|---|

| Points System | Essential | Starbucks "Stars" | Drives repeat visits, clear value proposition |

| Personalized Offers | High | Targeted coupons via app/email | Higher redemption, customer satisfaction |

| Tiered Rewards | Medium | Sephora’s Beauty Insider Levels | Encourages bigger spend, long-term engagement |

| Integrated Experience | High | Omnichannel earning/redeeming | Cross-channel data, seamless brand interactions |

When deployed thoughtfully, loyalty programs become not just a marketing expense, but an engine for retention and growth.

Content Marketing and Influencer Campaigns

Content marketing, in its many forms-blog posts, videos, shoppable social content-remains a core pillar of the retail marketing stack. Today, pairing this with influencer marketing creates a powerful blend of authenticity and reach. Brands like Glossier and Lululemon routinely collaborate with influencers who produce relatable, persuasive content that resonates with niche audiences.

What sets this strategy apart is the deep focus on storytelling, customer education, and community-building. Content-driven strategies may feel less "salesy," but they deliver compounding returns in SEO and organic reach.

Table 5: Content and Influencer Marketing Tactics

| Tactic | Primary Platform | Example Brand | Impact Metrics |

|---|---|---|---|

| Blog/Education Content | Brand Website, Medium | Glossier | Organic traffic, dwell time |

| Video Series | YouTube, Instagram | Lululemon | Views, social shares, engagement |

| Micro-Influencer Collab | Instagram, TikTok | H&M | Follower growth, conversions |

| Shoppable Posts | Instagram, Facebook | Sephora | Clicks to purchase, sales uplift |

A unique perspective worth considering: While influencer partnerships can be risky due to authenticity concerns or "influencer fatigue," the trend toward long-term, values-based collaborations is rebalancing the equation. The most successful retailers treat influencers not just as media channels, but as co-creators and community leaders.

The Interplay of Strategy and Execution

Retailers are increasingly aware that these five strategies do not operate in silos. Instead, the interplay between them-such as running in-store events promoted through digital ads and email campaigns, or linking loyalty rewards to content engagement-multiplies ROI. In a world where customer journeys zigzag through online research, social inspiration, email reminders, and physical visits, an integrated approach is indispensable.

Real-World Example: Target’s Omnichannel Mastery Consider Target’s approach: a shopper receives a personalized email about a weekend sale, clicks through to view featured products, sees a digital retargeting ad on Instagram, and finally visits a local store where they redeem a loyalty offer at checkout. Each step is powered by a distinct marketing strategy from our list, but together they create a seamless, persuasive experience.

Why These Five? The Enduring Logic Behind the Spend

Why do retailers keep pouring such a significant share of their annual budget into these areas, even as new marketing trends emerge? The answer is simple: measurability, scalability, and proven results. These strategies are not fads, but foundational pillars-each supported by robust analytics, industry benchmarks, and a clear link to sales outcomes.

As John Wanamaker famously quipped, "Half the money I spend on advertising is wasted; the trouble is, I don't know which half." Today’s retailers, empowered by data and technology, have never been closer to solving that mystery. By focusing spend on these five strategies, they maximize the odds that every dollar works harder, reaching the right customer at the right moment.

For those seeking to dive even deeper, explore resources like Deloitte’s CMO Survey or the National Retail Federation’s Marketing Benchmark Reports. These sources offer detailed breakdowns of spending patterns and emerging trends, helping marketers benchmark their own allocations and spot opportunities for optimization.

In the end, while new platforms and tactics will always beckon, these five marketing strategies remain the backbone of retail success-commanding both budget and attention, year after year. Whether you’re a startup founder or a Fortune 500 executive, understanding and mastering these pillars is the key to thriving in the ever-shifting world of retail.